INVESTMENT OPPORTUNITY

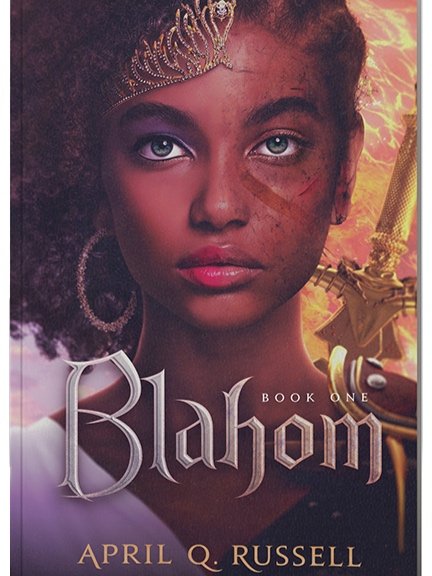

BLAHOM—a fresh, franchise ready IP with global appeal.

“A Warrior Goddess”: Sizzle Reel

Franchise Vision:

• Goal: 1M books sold in the trilogy series

Book 1 : A Warrior Goddess

Book 2: Claimed Destiny Undesired Journey

Book 3: Forthcoming Working Title

Market Insight:

The entertainment licensing market is projected to reach $515.3 billion by 2032, driven by the demand for cross-platform content .

Market Opportunity:

Themes of empowerment, identity, and the fight for legacy resonate across demographics. High potential for global syndication, streaming success, and brand partnerships.

Investment Snap Shot

-

“How You Can Own a Piece of Blahom’s Multi-Platform IP”

We are seeking $1 million USD in equity investment to fund the sales, marketing, and distribution phases of Blahom.

Investment Overview:

• Total Raise: $1,000,000 usd

•Minimum Investment: $250,000

•Micro-Raise Phase: $250,000 Pre-Seed

•Equity-Based and Revenue Share Hybrid Model

-

Market Validation

Total Addressable Market (TAM)

• Global YA Fantasy Book Market: $15.5B annually

• Projected Growth: 6.4% CAGR (2023–2028)

• Active Global YA Fantasy Readers: 300 million+

Target Demographics

• Core YA Audience: Ages 13–24

• Extended YA Fantasy Audience: Ages 25–35

• Serviceable Addressable Market (SAM): 104.57 million females, ages 15–55

Breakdown of Key Markets:

available in Data Room

-

Financial Projections

Book Sales Target (12-Month Goal)

• Units Sold: 1,000,000 books

IP Expansion Opportunities

1. Media Adaptations (TV/Film)

2. Licensing & IP Development

3. Merchandising

Product Lines: Apparel, posters, collectibles

BULK PURCHASE BOOK NOW

Buy books in bulk at wholesale rates for resale, corporate gifting, or community distribution.

FAQs

-

Each share represents a contractual revenue participation right—not equity or voting interest—in the Blahom intellectual property (IP). Investors receive 5% of net receipts from direct book sales and 1.33% of net ancillary revenues per share (including streaming, merchandise, licensing, and more), as outlined in the Investment Agreement.

-

No. This offering is exempt from SEC registration under Regulation D (for accredited U.S. investors) and Regulation S (for qualified international investors). It is a private offering and not open to the general public.

-

Revenue distributions will be made on a quarterly basis, contingent upon the generation of net income from book sales and ancillary sources. All payments will be handled in accordance with the terms specified in the executed Investment Agreement.

-

Shares are non-transferable without the prior written consent of Blahom’s executive team. This is to maintain the integrity and exclusivity of the investment pool. Exceptions may be considered under specific conditions as detailed in the Investment Agreement..